1. Introduction

The effective integration of sci-tech innovation and financial capital is significant for the implementation of innovation-driven development strategy. That is, without capital to support technological innovation, it is hard to develop new technology or new products, transform scientific and technological achievements, and promote industrialization. In our country, bank loans and capital market are the main sources of financing. Though bank loans are the most widely-used financing channels for innovative firms, we still need to determine which financing method works best to evaluate the effect of finance on innovation. Accurate evaluation of the integration provides practical significance for making government decisions related to sci-tech innovation.

Existing research has focused on the relation between direct financing, indirect financing, and innovation. Some results have shown that different sources of capital could affect the innovation ability and level. At different stages of the development of the capital market, it is significant[1-5], and regionally it is obvious[6-10].Bank loans are the main source of financing when the level of economic development is low, and the capital market is the main source when the economic level is higher[11-16]. Other scholars have demonstrated that public subsidies can promote the development of innovation [17], but they did not consider endogeneity. We try to take endogeneity into consideration to demonstrate the relation among different sources of capital and innovation.

2. Methodology

2.1. The Structural Vector Autoregression Method

The Structural Vector Autoregression (SVAR) model that was first proposed by Blanchard and Quah (1989) is a structural method that applies the long-term constraint conditions of economic theory on the VAR model. Because the VAR model does not consider the economic theory as a constraint condition while it implicates the current relation among variables in the random perturbation term, it cannot depict the relation of endogenous variables of the system in the period[18]. In this case, we need to analyze the structure of variables, that is, add the effects of variables in the period to the SVAR model. Assume that there are k variables in the model and the lag order is p, then the SVAR model is as follows:

Where

$B=\left[ \begin{matrix} 1 & \text{-}{{b}_{12}} & \cdots & \text{-}{{b}_{1k}} \\ \text{-}{{b}_{21}} & 1 & \cdots & \text{-}{{b}_{2k}} \\ \vdots & \vdots & \ddots & \vdots \\ \text{-}{{b}_{k\text{1}}} & \text{-}{{b}_{k\text{2}}} & \cdots & 1 \\ \end{matrix} \right]$, ${{\Gamma }_{i}}=\left[ \begin{matrix} \alpha _{11}^{(i)} & \alpha _{12}^{(i)} & \cdots & \alpha _{1k}^{(i)} \\ \alpha _{21}^{(i)} & \alpha _{22}^{(i)} & \cdots & \alpha _{2k}^{(i)} \\ \vdots & \vdots & \ddots & \vdots \\ \alpha _{k1}^{(i)} & \alpha _{k2}^{(i)} & \cdots & \alpha _{kk}^{(i)} \\ \end{matrix} \right],\text{ }i=1,2,\cdots ,p$, ${{u}_{t}}=\left[ \begin{matrix} {{u}_{1t}} \\ {{u}_{2t}} \\ \vdots \\ {{u}_{kt}} \\ \end{matrix} \right]$

Equation (1) is written as the lag operator, $B(L){{y}_{t}}={{u}_{t}}$ and $E {{u}_{t}}{{u}_{t}}={{I}_{k}}$, where $B(L)={{B}_{0}}-{{\Gamma }_{\text{1}}}L-{{\Gamma }_{2}}{{L}^{2}}-\cdots -{{\Gamma }_{P}}L$, $B\text{,} L$ is the parameter matrix of the lag operator L, $B\ne {{I}_{k}}$, $B$ is an invertible matrix with diagonal 1, ${{Y}_{t}}$ is a k-dimensional endogenous variable, and ${{U}_{t}}$ is the covariance that the white noise vector of the k-dimension structure with a mean of zero and a constant variance is not related to the period. For the k-dimensional p-order SVAR model, $k(k-1)/2$ constraints need to be applied to the structural formula to identify the structural impact. Therefore, to study the impact of direct financing and indirect financing on technological innovation, two SVAR models must be constructed.

2.2. The Relation Between Direct Financing, Indirect Financing, and Sci-Tech Innovation

To study the effects of two financing sources on sci-tech innovation briefly, the Cobb-Douglas function is used to measure the relation between them in this paper. Trading of technology market(TM),which includes the output of sci-tech innovation, is an explanatory variable, and financing sources including the amount of direct financing(ADF) and the amount of indirect financing (AIF) are taken as explained variables. Then, the Cobb-Douglas formula of knowledge production is determined as follows:

Where At represents technological innovation efficiency; TMt, ADFt, and AIFt represent the technological innovation output, direct financing, and indirect financing inputs in the tth year, respectively; α and β indicate the output elasticity of direct financing and indirect financing inputs respectively; and χ indicates other factors.

Taking the logarithm of both sides of Equation (2), the model is obtained as below:

There is endogeneity between direct financing and indirect financing, so we join the interaction of the two items in the model. When the coefficient of interaction is positive, direct financing and indirect financing are complementary; when the coefficient is negative, the relation of them is a substitution relation; if the coefficient is zero, there is no relation between them. The adjusted measurement model is as follows:

The Cobb-Douglas function was quantitatively analyzed with Eviews 6.0, and the following results were obtained:

As can be seen from Table 1, the interaction coefficient between direct financing and indirect financing is 0.027, which is greater than 0, indicating that direct financing and indirect financing are complementary but not significant. Therefore, in order to reduce the endogeneity between them, differential treatment should be conducted between direct financing and indirect financing in the measurement test of the SVAR model.

Table 1. Estimated structural relation between direct financing and indirect financing

| Coefficient | Standard deviation | t-Statistic | Probability | |

|---|---|---|---|---|

| LNSC | -0.267 | 0.452 | -0.590 | 0.5632 |

| LND | 0.851 | 0.227 | 3.753 | 0.002 |

| LNSC | 0.027 | 0.035 | 0.768 | 0.453 |

3. SVAR Model Construction

3.1. Variable Selection and Data Illustration

The main performance of the sci-tech innovation is the level of R&D, the transformation of scientific and technological achievements, and the level of industrialization. In this paper, there are five endogenous variables: direct financing amount (SC), indirect financing amount (D), technology market turnover (M), new product sales revenue (X), and high-tech product export volume (EX). They are used to construct the effects of direct financing and indirect financing on sci-tech innovation. Direct financing is measured by the sum of the amount of stock financing and the amount of the issuance of corporate bonds, and indirect financing is measured by the amount of loans of scientific and technological banks[3].

3.2. Metrological Test

3.2.1. Data Smoothness Test

In this paper, the ADF test method is used to test the stability of time series. The test results in Table 2 show that the first order difference sequence is stable.

Table 2. Time series and unit root test of first-order difference sequence

| Variable | ADF test | (T,C,L) | Critical value | Smooth or not? |

|---|---|---|---|---|

| LNSC | -2.745153 | (t, c, 0) | -3.277364*** | NO |

| LD | -2.469108 | (t, c, 1) | -3.286909*** | NO |

| LNM | -2.861176 | (t, c, 1) | -3.324976*** | NO |

| LNX | -2.180352 | (t, c, 0) | -2.655194*** | NO |

| LNEX | -1.527875 | (t, c, 3) | -3.310349*** | NO |

| DLNSC | -6.500128 | (0, c, 1) | -4.571559* | YES |

| DLND | -2.709937 | (0, c, 0) | -3.040391** | YES |

| DLNM | -5.475011 | (0, c, 0) | -4.571559* | YES |

| DLNX | -5.732749 | (0, c, 0) | -2.690439*** | YES |

| DLNEX | -2.954303 | (0, c, 0) | -3.040391** | YES |

3.2.2. Johansen Co-Integration Regression Test

The Johansen relation test of data shows that there are at least two cointegration equations between direct financing and indirect financing at 5% level of significance, which shows that there is a long-term stable equilibrium relation among the first order single integer variables.

Table 3. Time test results of the co-integration relation between direct financing and innovation effect

| Trace test Maximum characteristic root test | |||||||

|---|---|---|---|---|---|---|---|

| Number of the co-integration assumed | Eigenvalue | Trace statistic | Test level at 5% | Probability value | Statistical level of maximum eigenvalue | Test level at 5% | Probability value |

| None* | 0.9163 | 81.32 | 47.86 | 0.0000 | 44.65 | 27.58 | 0.0001 |

| At most 1* | 0.6986 | 36.67 | 29.79 | 0.0069 | 21.59 | 21.13 | 0.0431 |

| At most 2* | 0.3567 | 15.08 | 15.49 | 0.0577 | 7.94 | 14.26 | 0.3846 |

| At most 3* | .03273 | 7.13 | 3.84 | 0.0075 | 7.13 | 3.84 | 0.0075 |

Table 4. Time test results of the co-integration relation between direct financing and innovation effect

| Trace test Maximum characteristic root test | |||||||

|---|---|---|---|---|---|---|---|

| Number of the co-integration assumed | Eigenvalue | Trace Statistic | Test level at 5% | Probability value | Statistical level of maximum eigenvalue | Test level at 5% | Probability value |

| None* | 0.9587 | 100.59 | 47.86 | 0.0000 | 57.34 | 27.58 | 0.0000 |

| At most 1* | 0.8517 | 43.24 | 29.79 | 0.0008 | 34.34 | 21.13 | 0.0004 |

| At most 2* | 0.3012 | 8.89 | 15.49 | 0.3751 | 6.45 | 14.26 | 0.3751 |

| At most 3* | 0.1270 | 2.44 | 3.84 | 0.1179 | 2.44 | 3.84 | 0.1179 |

3.2.3. Granger Causality Test

According to the AIC criterion and the SC criterion, the delay period of the model is in the second phase, that is, P=2. The test results show that technology market turnover better displays the Granger cause of direct financing, and direct financing better displays the Granger cause of the export of high-tech products. In other words, they are the Granger cause of each other. Besides, indirect financing is the Granger cause of the turnover of the technology market, sales revenue of new products, and changes in the export of high-tech products.

4. Empirical Analysis

4.1. SVAR Model Recognition

Take the first order variance of the variables LNSC, LND, LNM, LNX, and LNEX that are in cointegration relation to one another to construct the VAR model first, and then construct the SVAR model by imposing restriction.

Structure identification matrix:

The number of the variable(replaced by n) is 4, that is, n=4, so we can obtain n(n-1)/2=6. In other words, to identify structural shocks, we need to set six constraint conditions. Thus, we make the following assumptions for the structure identification matrix B1:

$\cdot$ Direct financing does not affect the current export of high-tech products, that is, b14=0.

$\cdot$ The sales revenue of new products does not affect the direct financing of the current period and the export of high-tech products, that is,b31=b34=0.

$\cdot$ The export of high-tech products does not affect the direct financing of the current period, the turnover of the technology market, or the sales revenue of new products, that is, b41=b42=b43=0.

We make the following assumptions for the structure identification matrix B2:

$\cdot$ Indirect financing does not affect the export of high-tech products in the current period, that is, b14=0.

$\cdot$ The sales revenue of new products does not affect the amount of indirect financing and the export of high-tech products, that is, b31=b34=0.

$\cdot$ The export of high-tech products does not affect the direct financing of the current period, the turnover of the technology market, or the sales revenue of new products, that is, b41=b42=b43=0.

Therefore, B1 and B2 can be expressed as

${{B}_{1}}=\left[ \begin{matrix} 1 & \text{-}{{b}_{12}} & \text{-}{{b}_{13}} & 0 \\ \text{-}{{b}_{21}} & 1 & \text{-}{{b}_{23}} & \text{-}{{b}_{24}} \\ 0 & \text{-}{{b}_{32}} & 1 & 0 \\ 0 & 0 & 0 & 1 \\ \end{matrix} \right],\text{ }{{B}_{2}}=\left[ \begin{matrix} 1 & \text{-}{{b}_{12}} & \text{-}{{b}_{13}} & 0 \\ \text{-}{{b}_{21}} & 1 & \text{-}{{b}_{23}} & \text{-}{{b}_{24}} \\ 0 & \text{-}{{b}_{32}} & 1 & 0 \\ 0 & 0 & 0 & 1 \\ \end{matrix} \right]$

The order of variables in B1 is: direct financing, technology market turnover, new product sales revenue, and high-tech product export volume; the order of variables in B2 is: indirect financing, technology market turnover, new product sales revenue, and high technology product export amount. It reflects the recursive relationship between endogenous variables in long-term development. That is, direct financing and indirect financing affect the turnover of technology and sales of new products, which affects the export of high-tech products in turn. The parameter estimation results of the structural matrix of the SVAR model are shown in Tables 5 and 6. They show that direct financing has a positive correlation with indirect financing and technological innovation.

Table 5. Estimated results of current relation of SVAR of direct financing

| Coefficient | Standard deviation | Z statistic | Probability | |

|---|---|---|---|---|

| -b21 | 0.2508 | 0.0453 | 5.5331 | 0.0000 |

| -b12 | 3.1670 | 0.0814 | 38.8644 | 0.0000 |

| -b32 | 1.6385 | 0.1716 | 9.5485 | 0.0000 |

| -b13 | 1.5073 | 0.4585 | 3.2871 | 0.0000 |

| -b23 | 0.3862 | 0.1188 | 3.2502 | 0.0012 |

| -b24 | -0.3020 | 0.0228 | -1.4019 | 0.1609 |

| Log likelihood -30.20506 | ||||

Table 6 Estimated results of current relation of SVAR of indirect financing

| Coefficient | Standard deviation | Z statistic | Probability | |

|---|---|---|---|---|

| -b21 | 0.6660 | 0.0114 | 58.3206 | 0.0000 |

| -b12 | 1.6503 | 0.0788 | 20.9188 | 0.0000 |

| -b32 | 0.7370 | 0.2474 | 2.9787 | 0.0029 |

| -b13 | 1.2296 | 0.3106 | 3.9588 | 0.0001 |

| -b23 | 0.6095 | 0.2118 | 2.8772 | 0.0040 |

| -b24 | 0.0775 | 0.0092 | 8.3916 | 0.0000 |

| Log likelihood -2.582819 | ||||

4.2. Pulse Response Analysis

Impulse response analysis is aimed at illustrating the effects that shocks of each endogenous variable have on themselves and all other endogenous variables[18].This could reflect on the impulse response curve, and it is expressed that we give a standard deviation shock to a variable disturbance to demonstrate the impact of the initial shock (Shock) on the current and future values of each endogenous variable.

In this paper, the response process of each variable is set up for ten years. The analysis is as follows:

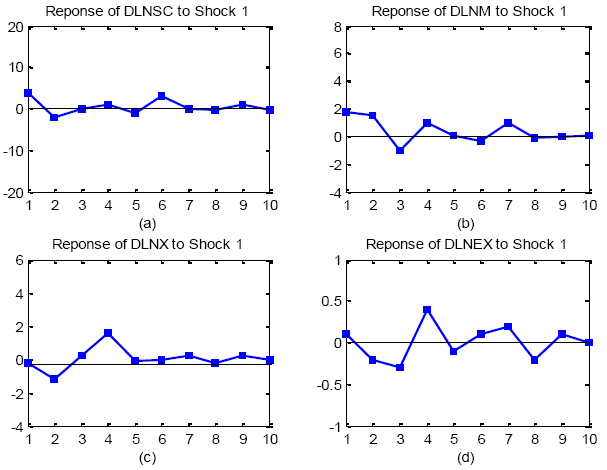

1) The impulse response of direct financing impact caused by technological innovation.

As shown in Figure 1, the direct financing is positive to the instantaneous and short-term response of the technical market turnover. In the first phase, when the maximum of 0.19 is reached, the direct financing increases by 1% and the technical market turnover increases by 0.19%. After that, the impact gradually decreases, but the overall trend tends to be positive. The instantaneous and short-term response of high-tech product exports is negative with new product sales revenue, and the post-impact force gradually increases and becomes a positive response in the third period. Therefore, the impact of direct financing on innovation output is positive and has certain continuity in the long run.

Figure 1

Figure 1.

Impulse response of sci-tech effect to direct financing impact

2) The impulse response of indirect financing impact caused by technological innovation.

As shown in Figure 2, indirect financing is positive to the instantaneous and short-term response of the technical market turnover. In the first phase, when the maximum reaches 0.85, namely when indirect financing increases by 1%, the technical market turnover increases by 0.85% and then weakens gradually. The relation of the new products sales and instantaneous and short-term response is negative, and the impact strengthens gradually. With drastic fluctuations, it will reach the maximum at the third and the sixth period respectively. Therefore, indirect financing has less impact on the research and development stage of technological innovation in the long run, but it has great impact on the result transformation and industrialization stage.

Figure 2

Figure 2.

Impulse response of sci-tech effect to direct financing impact

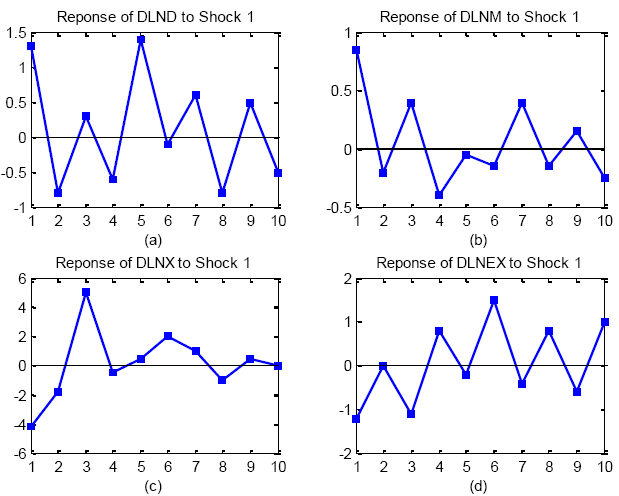

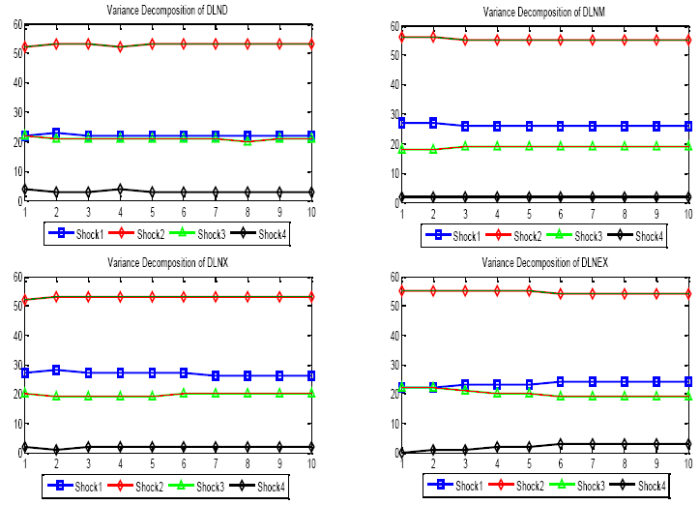

4.3. Variance Decomposition

Variance decomposition decomposes dynamic paths of each endogenous variable in the system into components that are related to the innovation (perturbed term) of each equation to understand the importance of the innovation to the model. It is designed to evaluate the contributions of each endogenous variable to the predicted variance. It can be thought that the variables are more important than the interpreted error, and they can have a long-lasting significant influence on the changes of the interpreted variables[18]. Figures 3 and 4 reflect the variance decomposition of the effects of direct and indirect financing on scientific technological innovation, respectively.

Figure 3

Figure 3.

The variance decomposition of direct financing

Figure 4

Figure 4.

The variance decomposition of indirect financing

(1) As shown in Figure 3, the contribution of the prediction error that direct financing affects innovation is positive, but the effect is weak; in the long term, its value remains at about 10%.The contribution of technology market turnover to direct financing is steadily maintained at 10%.The contribution of new product sales revenue, on the other hand, experiences a decline in short-term trends and then levels off at 10%.The contribution of high technology product exports has a rapid short-term growth trend and then is held steady. Therefore, the effect of direct financing on innovation is not significant in the short term, but it will become significant in the long term. The interpretation of the innovation output growth error is weak, and the contribution rate is smaller.

(2) As shown in Figure 4,the value is positive.The contribution of indirect financing to technology market turnover and new product sales revenue is about 25% and has been stable. For high technology product exports, the contribution is about 22%. Obviously, indirect financing affect sinnovation significantly both short-term and long-term, which means it can promote the development of science and technology innovation stablyin the long run.

5. Conclusions

The econometric model results show that both direct and indirect financing have a significant role in promoting the development of sci-tech innovation and present a complementary relation, which indicates that these two financing support models for sci-tech innovation complement each other. Combined with the empirical result analysis, it is obvious that both direct financing and indirect financing play a great role in promoting sci-tech innovation, and the complementary role is greater than the alternative[19-20]. There is a long-term and stable relation between direct financing and indirect financing and scientific and technological innovation, the financing scale of which plays an underlying role in the realization of scientific and technological innovation activities. Both have time-lag action in sci-tech innovation, reflected mainly in the short-term technology diffusion. The response of indirect financing to sci-tech innovation is greater than that of direct financing, which maintains the current financial system of sci-tech innovation activities dominated by bank financing.

Acknowledgements

This work was supported by the Social Science Foundation of Hebei Province of China, “On the Path of the Deep Integration of Science Technology and Finance of Hebei Province” (No. HB15GL029), and the Key Research Institute of Social Sciences of Institution of Higher Learning of Hebei Province.

Reference

A .Demirguc-Kunt, “Firm Innovation in Emerging Markets: The Role of Governance and Finance

”

Finance and Innovation: The Case of Publicly Traded Firms

”We hypothesize that established firms with innovative projects and technologies will make relatively greater use of arm's length financing (such as public debt and equity); whereas less innovative firms will tend to use relationship based borrowing (such as bank borrowing). The hypothesis is developed using a simple model in which firms with more innovative projects give greater discretion to managers by relying on arm's length financing. When a firm has less innovative projects that are easier for a relationship lender to evaluate, the manager is given less discretion and bank borrowing is more prevalent. Using a large panel of US companies from 1974-2000, we find that consistent with our predictions, firms that rely more on arm's length financing receive a larger number of patents and these patents are more significant in terms of influencing subsequent patents. The economic magnitude of the results is large: a one standard deviation increase in the arm's length financing variables of a typical innovating firm is associated with a substantial increase in its innovative output which, in turn,leads to more than 6%increase in its future value. We confirm our results by demonstrating that firms that issue public debt for the first time and firms that issue equity through an SEO exhibit a significant increase in innovative activity two years after the issue. Our results are robust to conditioning on financial constraints faced by the firm, firm size, R&D expenditure, market to book, firm maturity, unobserved time-invariant firm characteristics, the choice of a firm's decision to go to the public debt market and a variety of model specifications and variable definitions.

Innovations, Bank Monitoring, and Endogenous Financial Development

,”

DOI:10.1016/S0304-3932(96)01277-9

URL

[Cited within: 1]

We analyze the interaction between growth and financial development in a model of product innovation. Innovation is risky and can be monitored only imperfectly and at a cost. Financial intermediaries emerge endogenously to avoid the duplication of monitoring activities and negotiate contracts with innovators which induce optimal effort through a combination of incentives and monitoring. A positive correlation emerges between growth and financial development. The optimal degree of monitoring depends on factor prices and increases with capital accumulation. Improved monitoring, in turn, allows ‘banks’ to offer better insurance terms to entrepreneurs and yields a higher level of innovative activity.

Do Public Subsidies Stimulate Private R&D Spending

,”

How National and International Financial Development Affect Industrial R&D

,”

DOI:10.1016/j.euroecorev.2011.06.002

URL

[Cited within: 1]

78 We examine the impacts of both domestic and international financial market development on R&D intensities in OECD manufacturing industries. 78 We take account of such industry characteristics as the need for external financing and the amount of tangible assets. 78 Many forms of domestic financial development are important determinants of R&D intensity, with a particularly strong effect of bond-market capitalization. 78 Only foreign direct investment is significant among alternative measures of international financial development. 78 We relate these results to theories of investment monitoring with uncertain outcomes.

Financial Development and Innovation: Cross Country Evidence

,”

DOI:10.2139/ssrn.1745682

[Cited within: 1]

We examine how financial market development affects technological innovation. Using a large data set that includes 32 developed and emerging countries and a fixed effects identification strategy, we identify economic mechanisms through which the development of equity markets and credit markets affects technological innovation. We show that industries that are more dependent on external finance and that are more high-tech intensive exhibit a disproportionally higher innovation level in countries with better developed equity markets. However, the development of credit markets appears to discourage innovation in industries with these characteristics. Our paper provides new insights into the real effects of financial market development on the economy.

R&D Investment and Technological Progress: A Panel Study of Japanese Manufacturing Firms' Behavior During the 90's

”

The Link Between R&D Subsides, R&D Spending and Technological Performance

”

The Impact of Public Funding on Private R&D Investment: New Evidence from a Firm Level

,”

Factors Affecting University Industry R&D Projects: The Importance of Searching, Screening and Signaling

,”

Impacts of Public Funding to R&D: Evidence from Demark

,” in

Additionality of Public R&D Funding for Business R&D - A Dynamic Panel Data Analysis

,”

The Influence of Different Sources of Financial Capital on Enterprise's R&D Investment -- The Empirical Data based on Small and Medium Sized Listed Companies

,”

Financial Architecture and Economic Performance: International Evidence

,”

DOI:10.1006/jfin.2002.0352

URL

The paper examines the relation between the architecture of an economy's financial system—its degree of market orientation—and economic performance in the real sector. I find that while market-based systems outperform bank-based systems among countries with developed financial sectors, bank-based systems fare better among countries with underdeveloped financial sectors. Countries dominated by small firms grow faster in bank-based systems and those dominated by larger firms in market-based systems. The findings suggest that recent trends in financial development policies that indiscriminately prescribe market-oriented financial-system architecture to emerging and transition economies might be misguided because suitable financial architecture, in and of itself, could be a source of value. Journal of Economic Literature Classification Numbers: G1, G21, O1, 04.

A Comparative Theory of Corporate Governance

,”

Firm Innovation in Emerging Markets: The Role of Governance and Finance

”

DOI:10.1596/1813-9450-4157

URL

[Cited within: 1]

The authors investigate the determinants of firm innovation in over 19,000 firms across 47 developing economies. They define the innovation process broadly, to

Finance and Innovation: the Case of Publicly Traded Firms

”

DOI:10.2139/ssrn.740045

URL

[Cited within: 1]

We hypothesize that established firms with innovative projects and technologies will make relatively greater use of arm's length financing (such as public debt and equity); whereas less innovative firms will tend to use relationship based borrowing (such as bank borrowing). The hypothesis is developed using a simple model in which firms with more innovative projects give greater discretion to managers by relying on arm's length financing. When a firm has less innovative projects that are easier for a relationship lender to evaluate, the manager is given less discretion and bank borrowing is more prevalent. Using a large panel of US companies from 1974-2000, we find that consistent with our predictions, firms that rely more on arm's length financing receive a larger number of patents and these patents are more significant in terms of influencing subsequent patents. The economic magnitude of the results is large: a one standard deviation increase in the arm's length financing variables of a typical innovating firm is associated with a substantial increase in its innovative output which, in turn,leads to more than 6%increase in its future value. We confirm our results by demonstrating that firms that issue public debt for the first time and firms that issue equity through an SEO exhibit a significant increase in innovative activity two years after the issue. Our results are robust to conditioning on financial constraints faced by the firm, firm size, R&D expenditure, market to book, firm maturity, unobserved time-invariant firm characteristics, the choice of a firm's decision to go to the public debt market and a variety of model specifications and variable definitions.

The Comparison Study of Direct Financing and Indirect Financing Efficiency-An Empirical Analysis based on Commercial Banks in China and Shanghai Stock Market

,”